15-day risk-free trial

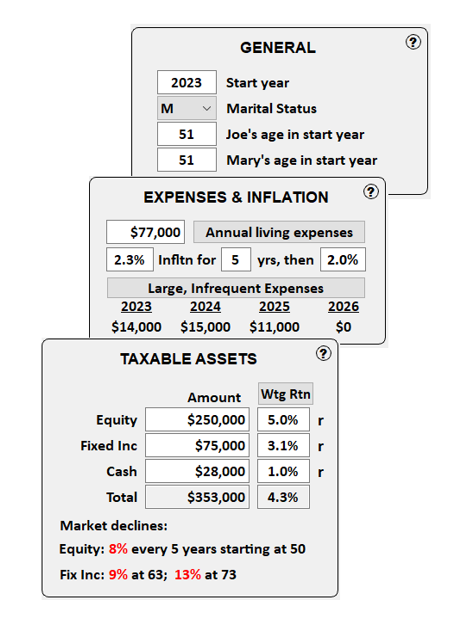

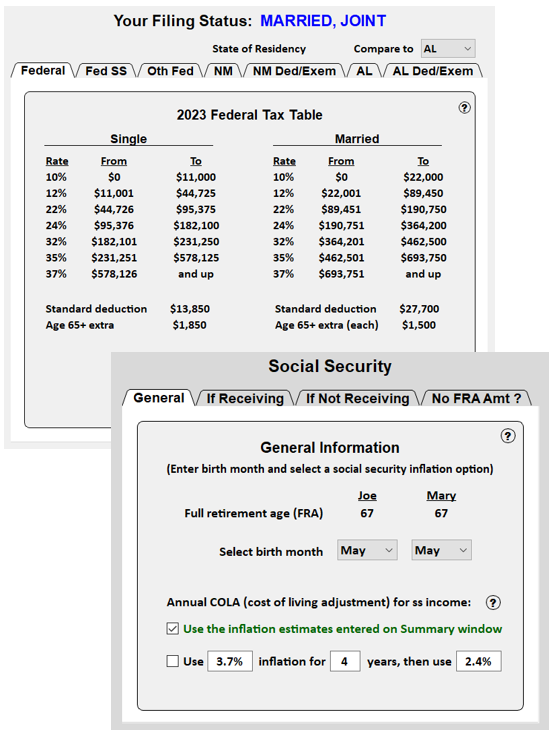

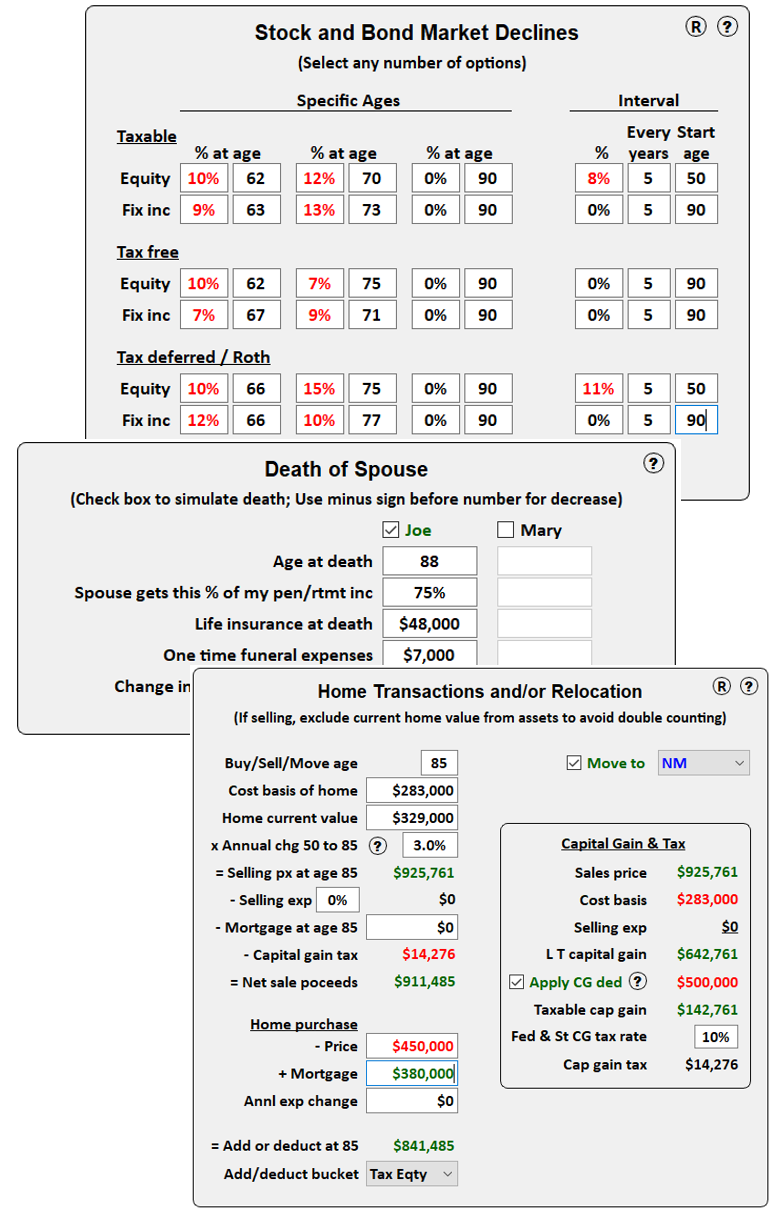

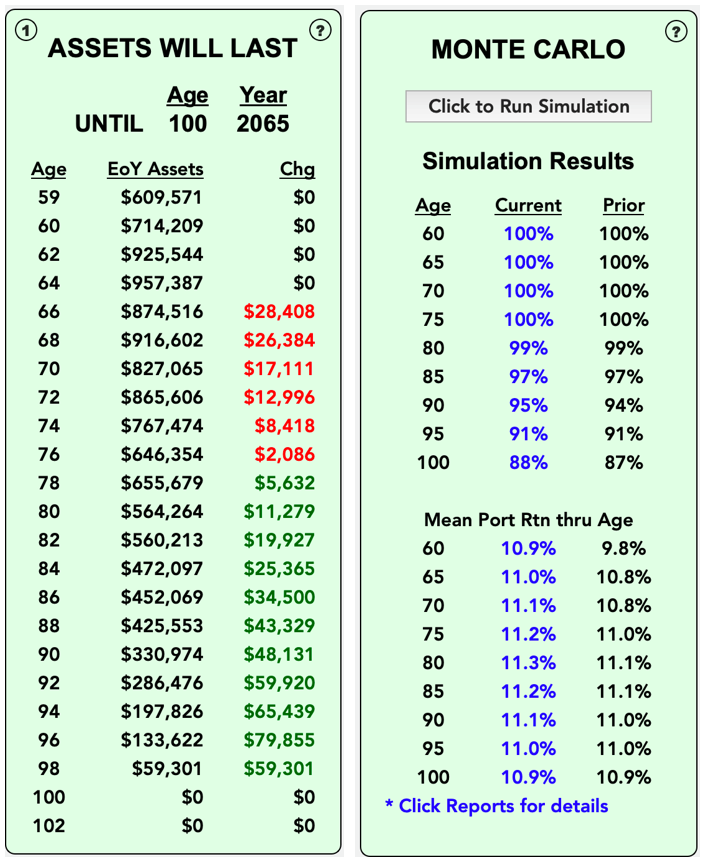

Using a full-featured planner, explore all of the above features, run countless retirement or "what-if" scenarios, and examine the detailed reports and charts before deciding to renew the license.

If satisfied with the planner, renew for less than the cost of dinner for two!

Not happy with our tool? Don't renew the license. It's that simple and risk free.

Since the Relax Planner takes into account more financial inputs than the other calculators I’ve tried, it provides what I consider to be a more accurate and complete picture of my future finances. In addition, this is the first calculator I’ve seen that has both a Monte Carlo simulation and allows you to enter your own estimate of annual returns. If you are serious about calculating your future financial condition, this is one you want.

— Gregg W, Montgomery, AL