Here’s a tool to determine ahead of time that a surviving spouse will have enough income and savings to live comfortably throughout retirement.

Confused as to whether to convert traditional tax deferred assets like an IRA or 401(k) to a Roth IRA? Our app can provide the answer for FREE…

Market volatility can be equivalent to taking a left hook from a heavyweight prize fighter! Find out what not to do..

Looking for a “good” retirement calculator but don’t know what to look for? Here are 5 “must have” characteristics.

The long running bull market may be over. How secure is your retirement in a prolonged bear market?

You’ve headed the warnings from financial experts and saved money for retirement throughout your working years, but have you planned for these two potential retirement land mines?

There are a few skeptics regarding the usefulness of retirement calculators. The Relax Retirement Calculator resolves their concerns.

Throwing money at a financial problem usually doesn’t help — you’ll be better off by identifying and fixing the cause of the problem. Here are some suggestions…

Considering moving to another state due to retirement or a company transfer? Regional price parities can help you determine how your purchasing power will differ in your new state.

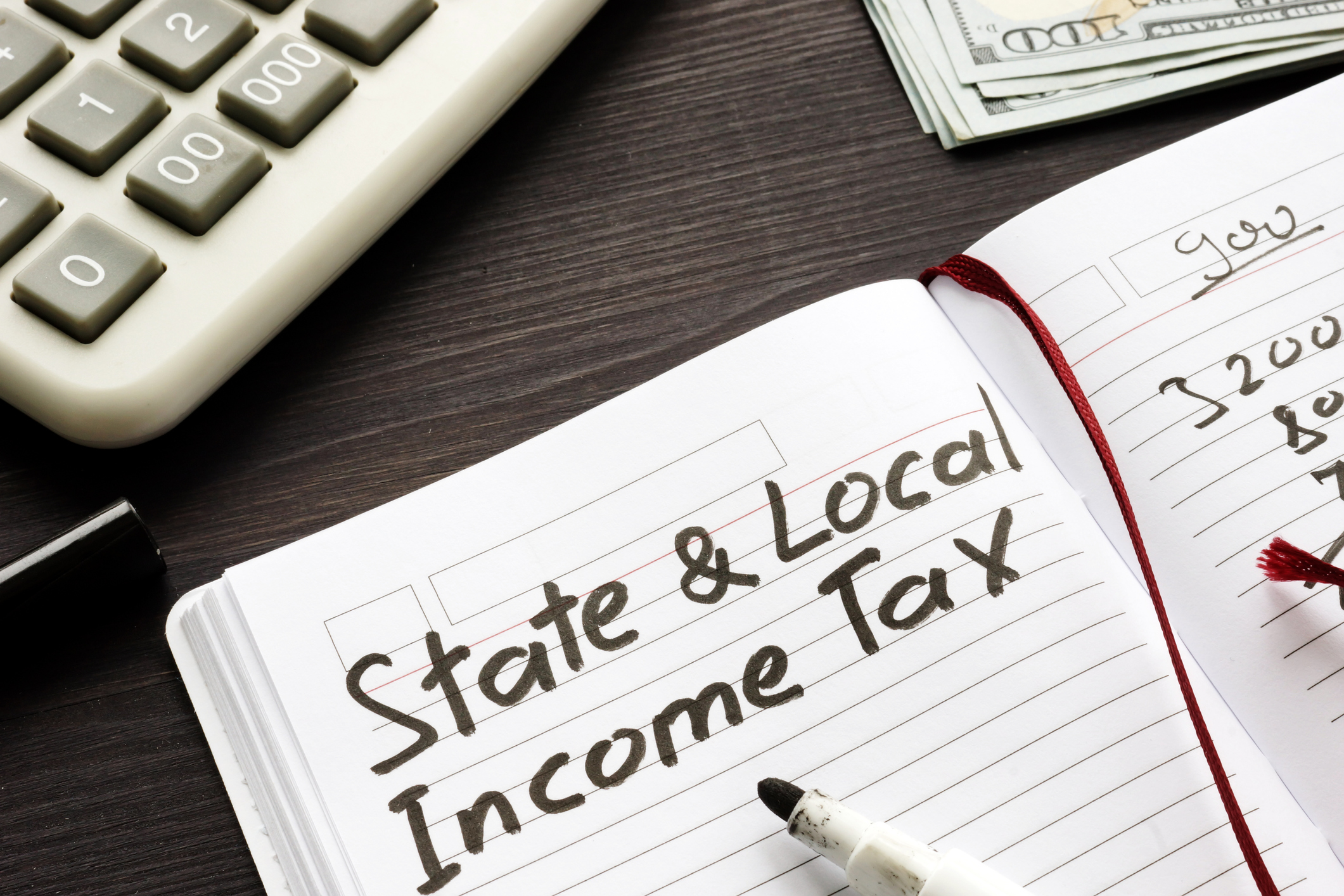

There’s no reason retirees should be afraid of the impact that state taxes may have on their retirement income. That’s because there are several “extra” exemptions and deductions that allow retirees to mitigate, and perhaps eliminate, state income taxes.

Why use “guesses” and “rules of thumb” when developing something as important as your financial retirement plan? Instead, use this tool to build an accurate, fact-based retirement plan you can have confidence in.

The economy has boomed for 10 years, the stock market has quadrupled, and real estate is soaring but the next recession may be right around the corner. Here’s how to get prepared for the next downturn.

Don’t waste valuable time trying to beat the market by picking individual stocks. Rather, just listen to Bogle and Buffett when planning for retirement.

Could Washington finally begin to address social security’s looming solvency problems? Recently introduced legislation provides hope, but don’t hold your breath…….

Don’t be complacent because the “headline” inflation rate remains low by historical standards. Instead, look below the surface to find the stealth inflation that could wreck your budget.

Baby boomers to millennials: Don’t be like us. We saved little during our working years and are now paying the price in retirement.

The Relax retirement calculator automatically calculates your social security income at any month or age.

Falling house prices, driven by millions of baby boomers selling at the same time, combined with the already low levels of savings of this age group, makes retirement planning all the more vital.

No, we’re not talking about your credit score, although that’s important too. Instead, we’re talking about the age when ……….

According to our detailed comparison of more than 20 retirement planners across 60 features, the most comprehensive, easy-to-use one is ……….

Are you ready to start planning your retirement but can’t decide which retirement calculator to use? There are so many calculators out there …….

It can happen to anyone. You turn 55, realize you’ve saved little for retirement and begin to panic because you’ve heard social …...

2025 Spirits Tax ($/gal)

Highest

- Washington $36.98

- Virginia $23.47

- Alabama $22.87

- Oregon $22.86

- N Carolina $18.23

Lowest

- Indiana $2.68

- Kansas $2.50

- Texas $2.40

- Colorado $2.28

- Missouri $2.00

Source: Tax Foundation

2025 Wine Tax ($/gal)

Highest

- Kentucky $3.38

- Alaska $2.50

- Florida $2.25

- DC $1.89

- Iowa $1.75

Lowest

- Kansas $0.30

- New York $0.30

- Wisconsin $0.25

- California $0.20

- Texas $0.20

Source: Tax Foundation

2025 Beer Tax ($/gal)

Highest

- Tennessee $1.29

- Alaska $1.07

- Hawaii $0.93

- Kentucky $0.89

- S.Carolina $0.77

Lowest

- Pennsylvania $0.08

- Colorado $0.08

- Wisconsin $0.06

- Missouri $0.06

- Wyoming $0.02

Source: Tax Foundation

2025 Cigar Tax

($/premium large cigar)

Highest

- Utah $5.07

- New York $4.42

- Alaska $4.42

- DC $4.19

- Colorado $3.30

Lowest

- Alabama $0.04

- Texas $0.01

- Pennsylvania $0.00

- N Hampshire $0.00

- Florida $0.00

Source: Tax Foundation

2025 St + Fed Cigarette Tax ($/pak)

Highest

- New York $0.32

- Maryland $0.30

- Connecticut $0.27

- Rhode Island $0.26

- Minnesota $0.24

Lowest

- South Carolina $0.08

- North Carolina $0.07

- North Dakota $0.07

- Georgia $0.07

- Missouri $0.06

Source: Tax Foundation

2024 Cell Service Tax

Highest

- Illinois 23.2%

- Washington 21.6%

- Arkansas 21.5%

- New York 20.6%

- Nebraska 20.4%

Lowest

- Hawaii 8.0%

- Virginia 7.8%

- Montana 7.0%

- Nevada 5.1%

- Idaho 3.4%

Source: Tax Foundation

2023 Migration

Inbound

- South Carolina 1.6%

- Delaware 1.0%

- North Carolina 0.9%

- Tennessee 0.9%

- Florida 0.9%

Outbound

- Illinois -0.7%

- Alaska -0.8%

- Hawaii -0.8%

- California -.9%

- New York -1.0%

Source: Tax Foundation

2024 Business Climate

Best States

- Wyoming

- South Dakota

- Alaska

- Florida

- Montana

Worst States

- Massachusetts

- Connecticut

- California

- New York

- New Jersey

Source: CNBC

Inflation (CPI)

| 2014 | 1.6% |

| 2015 | 0.6% |

| 2016 | 1.3% |

| 2017 | 2.1% |

| 2018 | 2.4% |

| 2019 | 1.8% |

| 2020 | 1.2% |

| 2021 | 4.7% |

| 2022 | 8.0% |

| 2023 | 4.1% |

| 2024 | 3.0% |

10 yr avg 2.7%

20 yr avg 2.6%

30 yr avg 2.5%

Source: Minneapolis Fed

Social Security Cost of Living Adjustments

| 2016 | 0.0% |

| 2017 | 0.3% |

| 2018 | 2.0% |

| 2019 | 2.8% |

| 2020 | 1.6% |

| 2021 | 1.3% |

| 2022 | 5.9% |

| 2023 | 8.7% |

| 2024 | 3.2% |

| 2025 | 2.5% |

10 yr avg 2.7%

20 yr avg 2.6%

30 yr avg 2.5%

Source: Social Security

2025 Gas Tax ($/gal)

Highest

- California $0.6982

- Illinois $0.6610

- Pennsylvania $0.5870

- Washington $0.5282

- Indiana $0.5250

Lowest

- Arizona $0.1900

- New Mexico $0.1888

- Hawaii $0.1850

- Mississippi $0.1840

- Alaska $0.0895

Source: Tax Foundation

State Income Taxes

Lowest Rates

- 1. AK, FL, NV

- 1. NH, SD, TN

- 1. TX, WA, WY

Highest Rates

- Minnesota

- Hawaii

- New York

- California

- New Jersey

Source: Tax Foundation

2025 Sales Taxes

Lowest Rates

- Delaware 0.00%

- Montana 0.00%

- New Hamp 0.00%

- Oregon 0.00%

- Alaska 1.82%

Highest Rates

- Alabama 9.43%

- Washington 9.44%

- Arkansas 9.46%

- Tennessee 9.56%

- Louisiana 10.12%

Source: Tax Foundation

2022 Property Taxes

Lowest Rates

- Hawaii 0.31%

- Alabama 0.39%

- Louisiana 0.54%

- Colorado 0.54%

- Wyoming 0.56%

Highest Rates

- Connecticut 1.76%

- Vermont 1.82%

- N.Hampshire 1.96%

- Illinois 2.05%

- New Jersey 2.21%

Source: Tax Foundation

Buckle up — the calculation for a social security survivor’s benefit is complicated….