Social Security at a Glance

Social Security was established in 1935.

Ernest Ackerman, the earliest known recipient for social security, retired one day after the program began. A nickel was withheld from his check to cover the payroll tax and upon retiring, he received a lump sum check for 17 cents (benefits were paid in one lump sum until 1940).

About 62.5 million people currently receive social security benefits.

About 20% of all people in the US receive benefits.

84% of all people age 65 and older receive Social Security.

About 25% of all US households receive benefits.

The average retiree receives $1,460 in monthly benefits.

Social Security comprises more than 90% of the total income for about a third of recipients.

SS benefits typically replace about one-third of pre-retirement earnings.

Once turning 62, your SS income to be received at any age will begin rising at the rate of inflation (CPI-W), regardless of whether you are collecting.

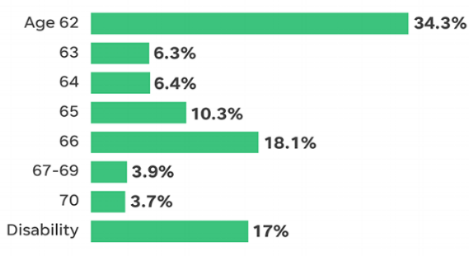

The Age People Begin Social Security

Ever wonder why so many people begin social security at age 62, especially when starting at that early age results in a 25%-30% reduction from what they would receive at their full retirement age (FRA) of 66 or 67?

Some of the more popular reasons:

They need the income. Survey after survey indicates most people nearing retirement have saved little, so they need social security to survive. Or, maybe they lost their job and have no other source of income.

They are in poor health or fear premature death. Some with poor health realize that waiting for higher amounts may not be worthwhile. Or, maybe giving care to a loved one with poor health prevents them from working.

They want to enjoy life. Some may not need the money but want the extra income to enjoy life while they are still relatively young and in good health.

They fear SS may go broke. While it's true that social security will have to cut benefits if Congress does nothing, these cuts will not surface until about 2034. So there's still time for Congress to act.

They don't understand the penalties for starting before their FRA. Some people are unaware their benefits will be reduced if they begin social security before their full retirement age.

They don't understand forfeiture rules. Beginning SS before your FRA and continuing to work could result in some or all of your benefits being temporarily withheld. Each year before your FRA, SS withholds $1 for every $2 earned above $17,040. Withheld amounts are returned (over time) once you reach your FRA.

Where the Money Comes From

The money to pay social security benefits comes from two sources:

Annual revenue, which is generated from:

A payroll tax of 12.4% on earned income up to $128,400, with the employer paying 6.2% and the employee paying 6.2%. Payroll taxes generate 87% of all the revenue.

Interest on the trust fund contributes about 9% of revenue.

Taxation of social security benefits from those collecting makes up the remaining 4%.

The Social Security Trust Fund, whose balance stood at $2.89 trillion at the end of 2017.

If Congress Does Nothing To Fix SS

For the first time since 1981, social security is projected to sustain a small deficit in 2018.

Steadily increasing annual deficits from 2018 forward will bleed the $2.89 trillion social security trust fund dry by 2034.

When the fund is depleted in 2034, payroll tax income and income tax on recipients’ benefits (the only two remaining streams of revenue) will only be able to pay about 79% of benefits.

Here’s our original article on Social Security’s solvency issues.

Determine Your Full Retirement Age

Year of Birth Full Retirement Age

1943-1954 66

1955 66 and 2 months

1956 66 and 4 months

1957 66 and 6 months

1958 66 and 8 months

1959 66 and 10 months

1960 and later 67

Find Your SS Income at FRA

Each year the Social Security Administration sends “Your Social Security Statement” that contains your earnings record and your estimated benefits.

For an immediate estimate, click here for the secure Social Security site that will calculate your benefits at full retirement age.

Calculate Your SS Inc at Each Start Age

To calculate your benefits at each start age, multiply the amount you will receive at your full retirement age by the percentage corresponding to your start age and your your full retirement age. The following table does not apply to “spousal benefits.”

You will receive this percent

of your FRA benefit amount

Start Age If FRA is 66 If FRA is 67

62 75.0% 70.0%

63 80.0% 75.0%

64 86.7% 80.0%

65 93.3% 86.7%

66 100.0% 93.3%

67 108.0% 100.0%

68 116.0% 108.0%

69 124.0% 116.0%

70 132.0% 124.0%

Our Relax Retirement Planner will automatically calculate, display and print your social security benefits, including “spousal benefits,” at any start month and age. It will also automatically calculate the social security earnings test (forfeiture rules, rebate amounts) and determine how much of your social security income is subject to federal and state taxes.

Social Security Benefits for Divorcees

If you are divorced, you will still be able to collect social security benefits based on your ex-spouse's record if:

Your marriage lasted at least 10 years.

You are still unmarried.

You are age 62 or older.

Your ex-spouse is entitled to SS benefits.

The benefit you are entitled to receive based on your own work is less than the benefit you would receive based on your ex-spouse's work.

If you start SS benefits at your FRA, your benefit will be equal to 50% of your ex-spouse's benefit at their FRA. If you start SS benefits before your FRA, your amount will be reduced depending on the age you start.

If you are eligible for retirement benefits on both your own record and your divorced spouse's benefits, social security will pay the larger of the two amounts.

Sources for all data: Social Security, 2018 Trustees Report, USA Today