For many years after the Great Recession, the economy limped along as it absorbed the excess labor and materials caused by the downturn. Mortgage rates were at generational lows, car loans were inexpensive and savings accounts were generating less than 1/2% annual interest. Inflation was running about 1.6% annually — virtually non-existent when compared to historical growth rates.

With low-inflation headlines every month for nearly 10 years, most of us were lulled into thinking we didn’t have to worry about it. Even as 2018’s economic rebound pushed inflation up modestly to about 2.0%, it’s still very tame by historical standards.

But don’t let the headlines claiming “tame inflation” fool you. Lurking below the surface of the published inflation numbers are much higher “stealth” increases in numerous everyday necessities.

Annual price increases that are double and triple the national inflation rate are prevalent whether it’s on big-ticket, headline-making expenses like housing, healthcare and insurance or on under-the-radar, everyday expenses like Cable TV, trash services and entertainment.

Paying attention to stealth inflation is important because rapid price increases can impact spending budgets, particularly if you’re a retiree with a fixed income and an already-tight budget. And now that the economy is booming, unemployment is at historical lows and excesses in labor and materials have evaporated, these costs could even accelerate going forward.

Here are areas where rising prices can sneak up and wreck your budget:

Housing

It took many years for the housing market to recover from the Great Recession. However, housing has been rising much faster than inflation over the past few years, especially in hot markets, including major metropolitan areas, such as Atlanta. The rapid price increases are primarily due to a strong labor market and a shortage of affordable housing brought on by curtailed building during and for several years after the Great Recession.

Overall, housing prices are projected to rise at twice the speed of inflation. Take hot retirement markets like Florida and the rate of increase has been much, much steeper. In 2013, the median Florida home sold for just $123,000. By 2018, prices had nearly doubled to $227,000.

For retirees who own their home, rising housing prices can be both a blessing and a curse. If you’re still sitting on your family home when retirement nears, you may be able to sell your house, downsize and live off of your profits. But be warned you may be in for sticker shock at that beachside house of your dreams.

Recent price increases are not limited to single family homes. Alternative types of housing like retirement communities or assisted living facilities may also give you sticker shock. Assisted living care costs rose nearly 7% in 2018 -- more than triple the rate of overall inflation – and the cost of a shared-room in a nursing home rose 4%.

Insurance

While retirees will get to enjoy Medicare and often won’t need health insurance, other insurance prices are on the rise. Auto insurance is becoming more and more expensive as the years go by. In fact, car insurance costs have recently increased at nearly five times the rate of inflation. If you’re going to be driving, be prepared to shell out a substantial amount to keep your car insured and on the road.

Remember what we wrote about rising home prices? Unfortunately, the increase in the cost and value of homes makes them more expensive to insure. Other factors, such as the seeming increase of natural disasters like wildfires and floods, will also push home insurance costs upwards. While homeowner’s insurance has not increased as fast as auto insurance, it still has increased at about three times the rate of inflation over the past three years.

Entertainment

You’re going to have a lot more time in retirement to participate in various leisure activities. Unfortunately, many popular forms of entertainment among retirees are rising at a fast pace. The cost of sports tickets, concerts, movie tickets and eating out are all rising much faster than inflation. Heck, even the cost of taking your grandkids to Disney World has increased at five times the rate of inflation.

Plan to stay at home? Many consumers are also complaining about skyrocketing cable plans as well. In fact, the recent shock of seeing the projected increase in my cable bill is what prompted this article. The basic cable part is rising 4%, twice the overall inflation rate. But the other charges are rising much faster: the mandatory Broadcast fee will increase a whopping 20%, the mandatory Regional Sports fee will increase at an even higher 22% rate, and the set-top box rental for additional TVs will increase 17% (on top of a 15% increase last year).

Fortunately, you can “cut the cord” and subscribe to cheaper alternatives, such as Netflix. However, if you do so, you’ll need a good Internet plan. Unsurprisingly, Internet plan pricing have also been trending upwards.

Healthcare

Virtually all healthcare costs are rising, some at a much higher rate than others. Take prescription drugs, for example, which increased at a rate 10X that of inflation in 2016. Although the increase moderated somewhat in 2017, prescription drugs are going to be a huge cost for anyone without health insurance. And if you have insurance, expect the rapid increase in prescription costs to push up your premiums. Even those on Medicare are not safe. The number of Medicare Part D patients with out-of-pocket costs in excess of $2,000 per year has risen increased by 7.3 percent over the past five years.

Further, you may reach the point when you need to pay for assisted living or a nursing home. Unfortunately, nursing home costs are skyrocketing, with the median cost of a room having reached just over $100,000 per year in 2018. Obviously, this is a huge cost and one that could really hit retirees.

On the whole, assisted living costs had been rising at over 4 percent per year for the last several years but spiked to a 7% increase in 2018 as we pointed out in the Housing section. With healthcare costs in general on the rise, assisted living and nursing home costs will likely only increase in the years ahead as demand surges from aging baby boomers.

Other Everyday Items

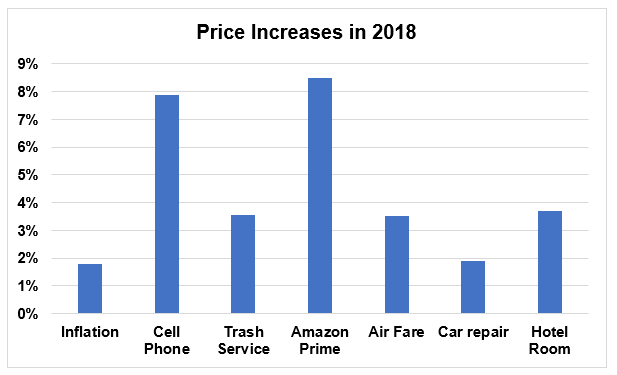

Rapid price increases are not limited to big-ticket items like housing, insurance and healthcare. Even the prices of lower-cost goods and services are rising much faster than inflation. Taken together, these price increases can take a toll on your budget. Like the rise in cable TV prices mentioned earlier, everyday necessities like cell-phones/service, trash service, air fare, car repair and hotel rooms are rising at rates well above inflation.

Stealth Inflation is a Real Concern, Especially for Retirees

Some costs have been trending down over the years. Grocery store foods are cheaper than they were forty years ago. The explosion of “fast casual” restaurants mean you can dine out on a tighter budget. And you can now pick up a great TV for under $500 bucks. So long as you manage your budget and are okay with foregoing the latest and greatest, you’ll be able to keep some costs in control.

Still, many costs are increasing much faster than general inflation, and sadly, many of these costs will disproportionately impact retirees, who are often on a fixed income. Stealth inflation is particularly hard on those retirees who are totally dependent on social security as that benefit increases only at a rate equal to national inflation.

Keeping yourself happy and occupied in your golden years is becoming more expensive. And while many businesses offer “senior discounts,” those discounts are now based off of more-costly items.

Unfortunately, stealth inflation is likely here to stay, at least until the next recession. Everyone, especially retirees on fixed incomes, must pay attention so they can plan accordingly.