While a dollar bill looks and feels the same all over the United States, its value is very different depending on where it is spent. We know this because stuff (housing, healthcare, rent, food, clothing) costs more in certain areas of the US compared to others. The value of your almighty dollar is higher and goes farther in places where goods and services are less expensive and is valued lower and purchases less in high-cost areas.

Why is it important to know that the value of a dollar differs from state to state? Well, you may be contemplating retiring to another state or maybe your company wants to transfer you across the country. In each case, you need to determine if your lifestyle will be better or worse in the new location, especially if you are on a fixed income or your compensation is not going to change.

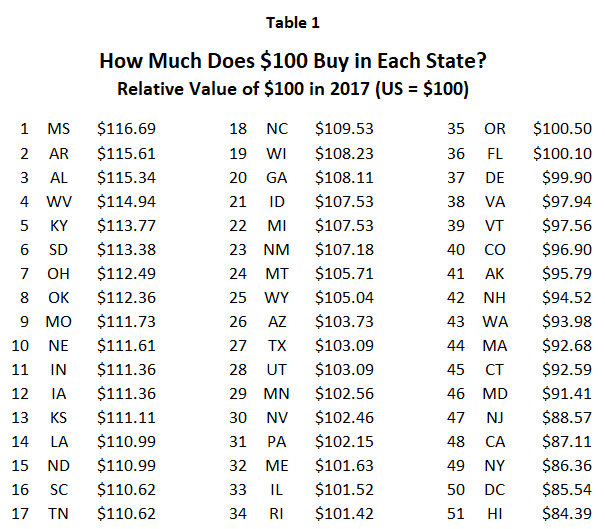

To determine how your lifestyle may change from one state to another, the Bureau of Economic Analysis (BEA) calculates regional price parities, which allow us to compare the value of a dollar in one state to the value of a dollar in another state. Stated differently, they measure the purchasing power of a fixed amount in one state vs another. For example, Table 1 shows the relative value of $100 across all states using regional price parities from the BEA and is ranked from the highest-value states to the lowest-value states. It essentially shows how much goods and services you can buy in each state relative to the US average of $100.

In Table 1, we see that $100 buys about $116.69 worth of goods in low-cost Mississippi relative to the US average of $100. In contrast, $100 buys only $84.39 worth of goods in a high-cost state like Hawaii -- 28% less than the amount it buys in Mississippi. Here’s another way to illustrate the value comparison among states: $100 worth of rent in Florida (near the US average) would cost about $116 in New York but only $86 in Mississippi. This means your dollar purchases more, and thus has greater value, in Mississippi compared to any other state.

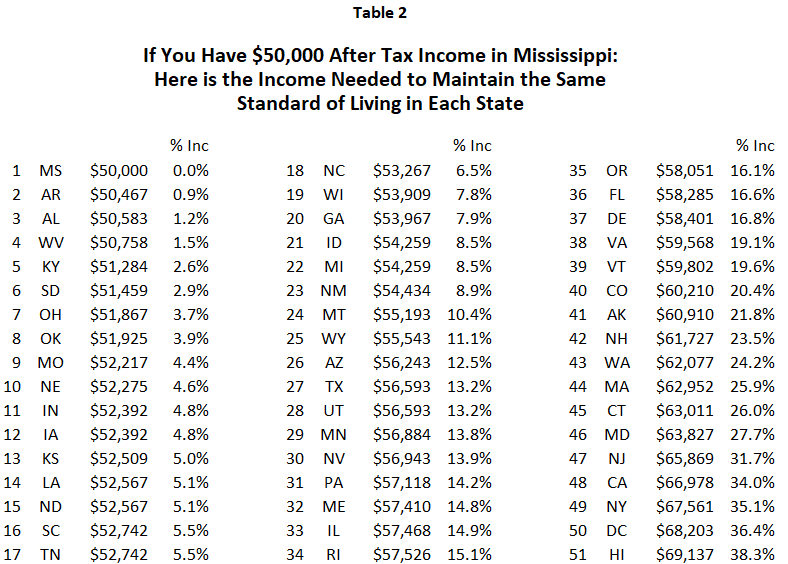

Differences in purchasing power between any two states can be determined by using Table 1. To illustrate, Table 2 assumes you earn $50,000 in after-tax income in Mississippi, the lowest-cost state. It then shows the compensation required in each of the other states to maintain the same standard of living you have in Mississippi. If you moved to Utah, for example, you would need to earn 13% more ($56,593) just to maintain your standard of living – your $50,000 salary does not purchase as much in Utah as it did in Mississippi. Moving to New York from Mississippi would require a 35% increase in salary to $67, 561 just to maintain your standard of living.

Conversely, if you made $50,000 in New York, you could take a pay cut of 16% to about $41,880 in Utah and still maintain your previous standard of living. However, maintaining your New York salary of $50,000 in Utah would translate into roughly a 19% increase in purchasing power to $59,700. A New York salary of $50,000 would be equivalent to nearly $67,600 (a 35% increase) in purchasing power in Mississippi. (Note: calculations in this paragraph are not shown in either table).

Whether moving or planning to retire to another state, it’s important to know how the cost of living differs from your current state. This is especially true if you’re retired and on a fixed income or if your compensation remains the same. Not knowing could make you regret the move and by then it may be too late.