Being an investor sometimes feels like being in a boxing match. The stock market’s seemingly endless volatility of “up big one day and down big the next” is like “jabs” to the head and “gut punches” to the stomach. The volatility can be mentally exhausting. And, after a while, it could make one want to give up and pull out entirely, just like Roberto Duran did when he evidently uttered the now-famous capitulatory phrase “no más” after being pounded for eight rounds by Sugar Ray Leonard’s speedy right-left jab combination in the 1980 Welterweight Championship.

Shouting “no más” and fleeing the market when “staggered” by volatility is likely the wrong move.

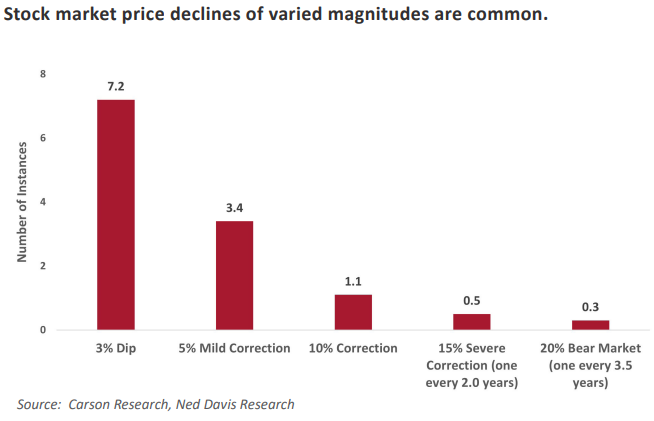

In fact, several Wall Street studies concluded that periodic market corrections, regardless of the rationale or magnitude, are not only common and normal, but healthy over the course of the business cycle. One recent study from Carson Research and Ned Davis Research showed that since 1928 the stock market suffers a 3% decline at least seven times annually. The study further states investors should expect more-meaningful declines of 5% between three and four times per year and 10% about once a year. Finally, market participants should anticipate a Bear market (i.e., a decline of at least 20%) about once every three to four years.

Just take 2023’s volatility as a reference. The S&P 500 turned in a gain of about 24%, well above the roughly 10% average annual return over the past several decades. The robust performance did not come without several brain-rattling head punches, however, like February-March’s 7% decline following the Silicon Valley Bank bankruptcy and October-November’s 10% decline related to higher interest rates and geopolitical turmoil. If investors had cried no más and fled the market, they would have missed not only the market’s complete rebound by the end of December but 2024’s early 8% gain as well!

But don’t let your guard down as the remainder of 2024 could resemble a three-fisted Mike Tyson throwing several powerful “left hooks” that come out of nowhere. For one, the S&P 500 is trading at nearly 21x (P/E), above its 25-year average of 16x. The premium suggests there is less cushion to absorb when bad news comes. In addition, the economy and labor market may slow as they begin to show the full brunt of the Federal Reserve’s interest rate hikes. Then, there is the continued geopolitical conflicts in Russia/Ukraine and the Middle East that, if sustained, could increase the price of oil and maritime shipping which, in turn, could re-ignite inflation.

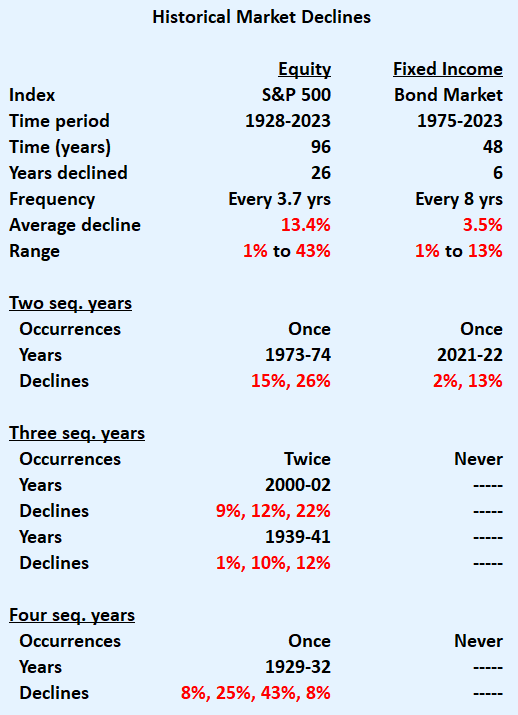

And, while intra-year corrections are mentally and financially painful enough, the pain can stretch over a few years as shown below.

Source: The Relax Retirement Planner

Rather than “throwing in the towel” during a painful, seemingly never-ending correction, investors may simply want to take a “standing 8 count” to settle their nerves and re-focus on the long term. Using the Relax Retirement planner to model the impact of a correction on your assets can provide the confidence you need to weather a correction. Remember, the black and blue marks caused by corrections will heal over time.

This post was adapted from an article written by Mitch Van Zelfden, CFA and portfolio manager at Truxton Trust in Nashville, TN.

Relax Software LLC is not registered as an investment advisor and does not provide investment advice. Nothing contained in this post should be construed as investment advice.