In our last post, we talked about retirement calculators and how beneficial they are as retirement planning tools. We examined the myriad of calculators available, the different types, what features to look for and things to watch out for.

In case you need a refresher, some important features of a good calculator include:

A self-explanatory, user-friendly interface that has a logical flow for entering assumptions and an understandable logic.

Key input assumptions should be contained on the first page to facilitate changing them quickly and easily. The answer should also be highlighted on the first page so the user can immediately see the impact of a changed assumption.

The ability to separate you and your spouse’s financial information, which increases the accuracy of the prediction.

Enough input assumptions so the calculator can generate a complete and accurate answer but not so many as to be confusing or cumbersome.

Automatic calculations (no manual user inputs) of federal taxes, individual state taxes, social security income at every start month and age, and IRA distributions.

To save our readers time and effort in finding well-rounded financial planning tools, we tested and examined more than 20 retirement planners. Our focus was to find and compare the features of those calculators that incorporated a sufficient number of assumptions to produce an accurate and complete financial projection. We wanted to make sure the planners not only incorporated the most important features/assumptions, but also presented those features in a user-friendly interface with a logical flow that a financial novice could understand.

The majority of planners we examined used less than six input assumptions for the basis of their projections, far too few to generate accurate retirement projections. In fact, some acted more like a function key on a hand-held calculator rather than a complete retirement planner. Most of these calculators are offered by large financial institutions simply as a “teaser” to entice the user to become a customer of the firm’s wealth management business. Brief comments on those that did not meet our criteria can be found in the section below labeled “Avoid these calculators if you’re serious about retirement planning.”

We found five calculators out of the more than 20 tested that had enough important features to warrant additional testing and a detailed comparison. After examining and using each one, we listed roughly 60 features we though important in a “good” calculator on a spreadsheet. Going line-by-line, we then put green check-marks to indicate if the retirement planner incorporated a particular feature and a red x if not. We also provided information on each planner, including its parent company, web address, cost, type of planner, and the financial information the planner predicts. Lastly, based on our testing, we offered subjective opinions on the calculator’s appearance, functionality/flow, understandability and its ease of use. Click to see our detailed feature-by-feature comparison among the five calculators.

And the best retirement calculator is …

The Relax Retirement Planner by Relax Software LLC

https://www.willmysavingslast.com

You might think it’s a bit presumptuous to label our own retirement calculator the best. Here’s the thing: When we set out to develop the Relax Retirement Planner, we first examined all of the best financial planning calculators available. We figured what they did well, where they fell short, and what we could do as good or better.

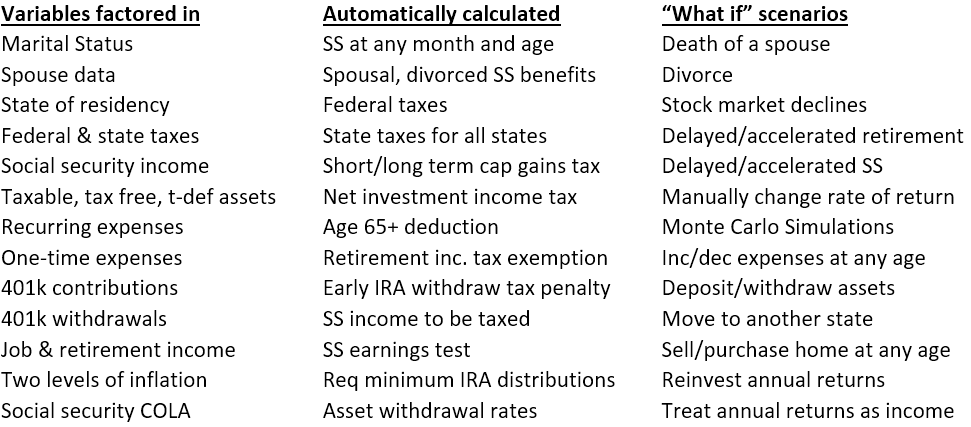

The Relax Retirement Planner is a downloadable software program (available on Windows and Mac OSX) that calculates how long will your savings last. The planner has just the right amount of understandable input assumptions to derive a complete, accurate projection but not so many as to confuse the user. If you look at our detailed comparison, you will find Relax Retirement has everything a serious, non-technical user needs to calculate an accurate and complete set of retirement projections.

You’ll notice right off that most of the key user inputs are nicely presented on the main window in a clear, logical, easy-to-use interface. As assumptions are changed, the answer recalculates automatically and is displayed in the colored, easy-to-read answer box located on the same window. This summary answer is supported by 19 detailed reports and 9 charts with the click of a button. As a bonus, users may customize the appearance of the windows and charts to their liking.

The Relax planner is easy to use and informative. In addition to a built-in user guide, it displays messages that not only alert a user when entering historically “excessive” asset returns but also provide hints to maximize social security income. Importantly, these messages can be turned off if the user becomes annoyed with them.

What sets Relax Retirement apart from the others is automatic calculation of complex variables such as social security, federal taxes and state-tax areas. For example, some calculators ask the user to input their social security income, but SS income varies by start age. So if a user does not know when they will start social security, what amount do they to enter? Relax Retirement automatically calculates social security for both spouses (even “spousal” benefits) at any start month and age — each time the user changes their start age. That way, the user can try various start ages and see the impact of higher or lower SS income on their savings. No other calculator we tested does this.

Similarly, most calculators ask for an assumed federal tax rate, but how does the user know what tax rate to use 15 years in the future? Relax Retirement automatically calculates federal taxes using inflation-adjusted statistics (tax brackets, standard deduction amounts, etc.) and incorporates the standard vs itemized deductions when determining taxable income. It even determines how much of your social security income to tax.

The same goes for state taxes. Relax Retirement calculates each state’s taxes using that state’s unique tax rates, brackets, standard deduction and personal exemption amounts. It even determines if your state taxes social security. Only one or two of the other 20+ calculators even accounted for state taxes and that was done by using a flat rate.

The calculator sells for $69.95 but there is a no-risk, 60-day money back guarantee that allows a refund for any reason.

Honorable Mentions

Let’s take a look at the best of the rest. Of course, we did not test every calculator on the market and may have made unintentional mistakes or misinterpreted some features on the other calculators in our detailed comparison. However, while other untested calculators may also be good, you cannot go wrong with the Relax Retirement Planner. If the Relax Retirement platform isn’t right for you, these two calculators (in no particular order) may be worth exploring.

Personal Capital Retirement Planner by Personal Capital Corp.

The web-based Personal Capital Retirement Planner integrates your banking and investment accounts into a personal dashboard from which you can monitor activities and balances. Personal Capital Corp, the retirement planner’s parent company, is a wealth advisory and money-management firm.

While the integrated dashboard approach looks nice and appears novel, it can also be annoying if you only want a retirement planner and are not interested in becoming a customer of the firm. For example, after setting up the mandatory log-in account, users are required to immediately link their regular bank and investment accounts to Personal Capital – before allowing you to see the menu of retirement tools. We found no way to circumvent this annoying linkage process. And upon each subsequent log-in, users are once again asked to link all of their accounts.

If you can overcome the mandatory linking of accounts and find the tools, the retirement planner appears solid. Although we found the planner slightly confusing when first starting, the program incorporates all of the important inputs needed to arrive at a complete and accurate answer. The drawback with its input assumptions is that it requires flipping through several web pages to enter and again to edit them.

When compared to the Relax Retirement Program, Personal Capital falls short in a few critical areas. One place is in the “automatic calculations” areas, such as federal/state income tax calculations. Personal Capital has the user manually enter a tax rate to calculate federal taxes prior to retirement and then uses the 2018 tax rates to compute taxes after retirement. Relax Retirement, on the other hand, calculates federal taxes using 2018 rates/brackets, itemized deductions and standard deductions throughout its 80-year projection period.

Further, Personal Capital uses a flat rate for state taxes while Relax Retirement uses each individual state’s rates/brackets as well as exemptions and standard deductions. Lastly, Personal Capital falls short in social security, where it has the user manually input expected social security income compared to Relax Retirement’s automatic calculation of social security at any month and age.

If you can get past the annoying “gatekeeper aspect” of having to link your accounts and the deficiencies in “automatic calculations,” Personal Capital’s retirement planning tool may be beneficial.

The Flexible Retirement Planner by Random Walk Ventures LLC.

The downloadable Flexible Retirement Planner is one of the early pioneers of retirement calculators. It’s a versatile, but very complex calculator with sub windows and certain user inputs that can be difficult to understand.

Like Personal Capital, the Flexible planner projects how long your savings will last and attaches a probability of achieving your savings goals using Monte Carlo simulation. The planner uses a traffic light to visually translate the probability of achieving your savings goal by flashing a red (low probability), yellow (cautious probability) or green (high probability) light.

Although a long-standing stalwart of retirement calculators that will give you an accurate and complete answer, the planner’s versatility makes it very complex and a little confusing, especially to a user who is not financially savvy. We found some of the user inputs can be confusing and complicated, especially on the Settings window. We also believe some users will have trouble understanding parts of the user interface, particularly when attempting to enter information on the “additional inputs” window. To unlock the planner’s full potential, the user sometimes needs to be a “techie finance” person because it will ask you to input things like “standard deviations.” We believe this required knowledge is beyond the average user.

Given the planner’s complexity, we would have thought a help button or user guide would be embedded within the program for quick reference, but users are required to visit the website for explanations. While this is a somewhat trivial point, we believe Flexible is showing its age and could use a design update for a more attractive format and logical flow.

We also discovered the Flexible planner does not automatically calculate federal taxes, social security, mandatory IRS distributions or allow voluntary IRA withdrawals. Moreover, it does not even account for state taxes. Like the Personal Capital planner, we believe the absence of these features puts the Flexible Planner at a glaring disadvantage when compared to the Relax Retirement Planner.

If you can master the Flexible Retirement Planner’s intricacy and overlook its shortcomings in “automatic calculations,” we believe the planner will deliver an accurate and complete answer.

Avoid these calculators if you’re serious about retirement planning

Below are brief comments and opinions on those calculators we tested but did not qualify for our detailed comparison of features. We believe they do not present an accurate and complete picture of your financial future because they allow for too few input assumptions. As such, they are more “investment” calculators rather than full-featured retirement calculators.

Most of these investment calculators are associated with large financial institutions involved in banking, retirement counseling, financial planning, money management, mortgage lending, and stock brokering. We believe they want to entice you to become a customer rather than provide a comprehensive calculator. In fact, we received several marketing solicitation calls from some firms after having had to provide our phone number to “log-in” and test the calculators.

Dave Ramsey’s Investment Calculator (web based)

As an investment calculator, it has minimal inputs and only shows the growth in assets given an assumed rate of return.

Financial Mentor Ultimate Retirement Calculator (web based)

Several decent inputs, but not the ones we think are necessary. There is no input for current employment income, no separation of assets into taxable and tax deferred, no separation of spouse data, a manually entered estimated tax rate, no state taxes considered, only one report is generated and there are no charts. It projects total savings at retirement. Even with limited inputs, it’s a little confusing.

Voya myOrangeMoney Retirement Calculator (web based)

The myOrangeMoney calculator asks only five questions and “assumes” the other important variables (seems like a “one size fits all” approach).

Prudential Retirement Calculator (web based)

Prudential asks a few questions and projects your monthly retirement income and the retirement income needed. At the end there is a “Send me my results” button whereby they get your information in order to contact you – probably to get you to open an account.

Betterment Savings Calculator (web based)

Betterment says: “This Retirement Savings calculator is a simplified version of Betterment’s retirement advice.” In other words, they likely want you to sign up as a money-management customer to sell you advice. The calculator asks a few questions and projects your retirement income starting at the user’s selected age. It makes unknown assumptions regarding social security income.

Nerd Wallet Retirement Calculator (web-based)

The Nerd Wallet calculator asks only a few questions and projects the amount of assets you will have and the number of assets you will need at your projected retirement age.

CalcXML (purchase and download)

CalcXML provides various types of calculators for $1,145 annually that can be installed on a website, like a mortgage calculator a realtor may install on their personal site. There are lots of calculators offered, but like a function key on a hand-held calculator, each one addresses only one financial issue.

SmartAsset Retirement Calculator (web-based)

SmartAsset is a banking/financial advice/mortgage firm that provides various types of calculators. The retirement calculator asks a few questions, makes assumptions on the other important information, and spits out an estimate of your assets at retirement. We believe their goal is to get you to sign up for retirement advice.

American Funds/Capital Group (web-based)

Capital Group/American Funds offers both a quick and detailed version of its calculator. The quick version asks four questions – need we say more? The detailed version is contained in our line-by-line feature comparison.

Edward Jones Retirement Savings Calculator (web based)

Enter seven items and it tells you what your savings will be at retirement.

Bankrate (web-based)

Bankrate’s calculator predicts total assets over your expected retirement years. It allows printing of assumptions, shows a summary of inputs and produces one report. It makes general assumptions about your social security. However, with a limited number of inputs, we feel it is inadequate.

Merrill Lynch (web based)

The Merrill calculator asks six questions and then predicts the assets you will need to retire and the annual retirement income you will need to fund your spending. It’s possible that Merrill Lynch customers get access to a more detailed plan.

Fidelity Retirement Analysis (web based)

Fidelity has two calculators. One is a simple version on the website that asks a few questions and then predicts your retirement “score,” a measure of whether you are on track to achieve your input goals. Logging into Fidelity.com with a guest account gets you to a more detailed planner with more inputs. However, we found it very confusing, not well designed, and difficult to edit entries. Like Merrill Lynch, we suspect a customer of Fidelity gets a better version and/or a consultant to walk users through the planner.

Vanguard’s Retirement Nest Egg Calculator (web based)

While attractive and easy to understand, Vanguard’s calculator asks only a few retirement questions and projects how long your nest egg will last. Although it does allow an asset breakdown into stocks/bonds/cash and runs a Monte Carlo simulation, we feel it excludes most of the important input assumptions. Vanguard also has a retirement income calculator that has several more input assumptions but is not integrated into the retirement calculator.