There are a few skeptics regarding the usefulness of retirement calculators. Some of the criticisms are deserved, some are not. It all depends on the calculator as all calculators are not created equal.

An acceptable retirement calculator with reasonable input assumptions can be a valuable planning tool. Trouble is, many “poor” calculators provide inaccurate predictions even with reasonable input assumptions because they do not incorporate enough variables to derive a complete, accurate projection.

However, just because you find a “good” calculator doesn’t mean the answer it spits out will be representative of your financial future. You’ve heard the adage “garbage in – garbage out.” This also applies to retirement calculators. You see, the projections made by a retirement calculator are only as good as the assumptions the user enters into it. Unrealistic assumptions will generate unrealistic financial projections, so it’s important to be realistic or you are only hurting yourself.

So, what are the skeptics skeptical of? We’ve taken a few of their criticisms, explained the reasoning behind their skepticism, and provided the Relax calculator’s solution to overcoming their objections.

Retirement calculator criticism #1: Too few inputs

A big criticism (and deservedly so) of most retirement calculators is the lack of sufficient number of inputs to derive an accurate and complete prediction. Too often a calculator, usually one of the seemingly hundreds of “free” web-based calculators, considers only two to four inputs before spitting out an estimate of how long your retirement savings can last. Fact is, it’s impossible for calculators with only two-four inputs to generate a meaningful picture of your retirement. Sure, the results may be mathematically correct based only on two-four inputs, but there are not enough to prepare a realistic picture of your retirement savings longevity. These calculators are typically designed to get you into the door, then “upsell” you something the sponsoring firm can make money on. Don’t waste your time on them.

The Relax calculator’s solution: Enough inputs to ensure accurate results

The only way a calculator can generate trustable, realistic results is to incorporate all of the important inputs, including:

Marital status

Spouse data

State of residency

Automatically calculated federal and state taxes

Social security

Taxable, tax-free and tax-deferred assets

Recurring and one-time expenses

401k/IRA withdrawals and contributions

Employment, work in retirement and retirement incomes

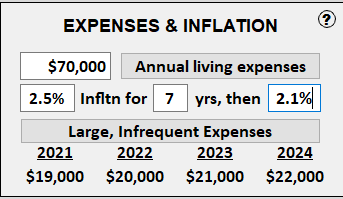

Two levels of annual expense inflation

Annual social security income COLA

Changeable start and end ages for all inputs

Ability to test “what if” scenarios

An appropriate number of inputs is only one of several components of a good retirement calculator.

Criticism #2: Estimating Longevity

Some calculators ask the user to input their life expectancy, but critics say longevity cannot be estimated with any accuracy. It’s merely a guess because of the many factors involved such as health, family history, and luck. And, using actuarial tables are no help because they are only accurate for large numbers. Further, life expectancies are increasing, which could throw wrenches into these traditional longevity determinants.

The Relax calculator’s solution: Don’t estimate longevity

We agree with the critics on this one. Since life expectancy is unknowable, the Relax planner does not even ask. Rather, it calculates how long your savings will last based on many critical assumptions and provides 80 years of projections beginning with your current age.

Moreover, the planner calculates the change in your assets that occurred as a result of the last variable change and displays it in color for easy visualization. This way, users can search for the right combination of variables to maximize the longevity of their savings or maximize their savings at a particular age.

Criticism #3: Estimating Annual Spending

Conventional wisdom says that retirees will spend 70%-85% of their preretirement spending during retirement. Accordingly, most retirement calculators ask the user to key in the percentage of preretirement spending they think they will need in retirement. The truth is, most people have no clue how much money they spend before they retire, much less what they will spend during retirement. Since spending levels are critical in determining the longevity of your savings, accuracy is important.

The Relax calculator’s solution: Lump sum and a worksheet

We allow the user to enter a lump sum of their annual recurring living expenses rather than a percentage of their current spending. If users are unsure of what they will spend, we provide a detailed, category-by-category worksheet to estimate spending. These recurring expenses will then increase each year by the rate of inflation the user assumes.

In addition, we allow the user to separate their normal recurring expenses from one-time expenses such as a wedding, a house remodel, or college tuition. That’s so these infrequent items will not be bundled with recurring expenses and increase each year at the rate of inflation.

The bottom line is that only retirees can accurately determine what they will spend in retirement and they must accept responsibility to use accurate assumptions. Close monitoring of what is actually spent and periodic updating of spending estimates will result in more accurate predictions.

Criticism#4: Estimating Inflation

Skeptics believe users cannot accurately estimate inflation because no one knows how much prices will rise in the next year let alone in the next 30 years. They say it’s futile to guess.

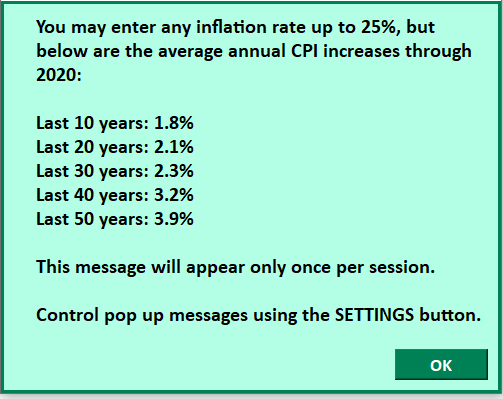

The Relax calculator’s solution: User chooses two levels

Example of real-time user guidance

We believe recent and longer-term history can be used to estimate inflation in the future. No, it may not be exactly accurate in the next year or two, but it’s better than no estimate or an estimate of 0%. The Relax planner not only allows users to enter two estimates of inflation (see previous image above) it also provides in-planner reference regarding historical rates of annual inflation during various periods in the past 50 years. Sure, there are periods of rapid inflation and periods of low inflation, but it averages out to a relatively narrow range over time. A simple solution is to create several scenarios with varying rates of inflation to gauge the impact on the longevity of your nest egg.

Criticism #5: Estimating Annual Investment Returns

One of the most debated topics about retirement calculators is the rate of return a user should assume. The criticism tends to be directed at flat-rate calculators, which use a fixed rate to grow assets in a linear fashion each year throughout the projection period. The criticism centers on the non-variable nature of the fixed rate, an issue often referred to as the sequence of returns.

To illustrate the sequence issue, let’s assume assets will compound each year at a flat-rate of 5%. Everyone knows the market does not increase by 5% each and every year in a linear fashion. In fact, it varies each year. Well, what if the market declines 5% in each of the first two years of your retirement? Since a flat rate calculator is compounding your assets 5% annually, your savings will be overstated in the first two years. Over 10 years, this temporary overstatement may not matter because the market could rise 10% or more in any given year and still end up averaging the 5% assumed rate of return. However, if late in retirement and you are withdrawing from savings to live, two consecutive big down years in the market may quickly deplete your savings because there is not enough time to make up the initial decline.

This potential sequence of returns issue is why some calculators use Monte Carlo simulation, which replaces a flat-rate’s linear returns with randomly picked actual historical returns. Monte Carlo first asks how may years the user expects their retirement to last. The simulation then selects an actual, but random historical return as the assumed return in each year of the retirement period. It repeats this analysis thousands of times using different random historical returns in each analysis and determines whether your savings lasted your entire retirement on each analysis. When finished, it gives you the percentage of time your savings lasted your entire retirement.

Although it uses variable rather than flat-rate returns, even Monte Carlo has its critics. They point out that users must input the number of years they expect to be retired at the beginning of the analysis, but how many retirees know that number, especially when they may be only 40 years old? Moreover, critics say using random historical returns could also result in non-accurate projections because history (historical annual returns) will not repeat itself, especially not in the exact sequences used by the simulation.

The Relax calculator’s solution: Allow traditional returns AND Monte Carlo

There are drawbacks to each method when used individually. That’s why our calculator allows both methods when projecting how your savings will last.

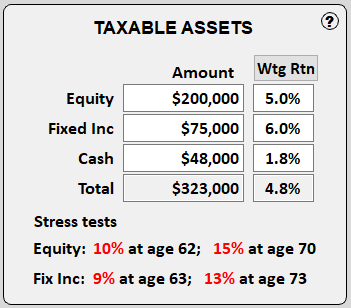

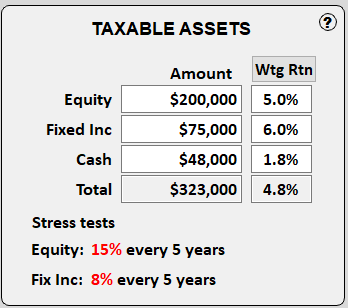

First, the Relax calculator allows users to manually enter (and change) their expectation of annual returns in the traditional way for each asset class.

Then, it allows users to test the impact of market declines at various individual ages for each asset class. Or, users can set up a “recurring” stock market decline every so may years. These two types of “stress tests” solve the sequence of returns issue.

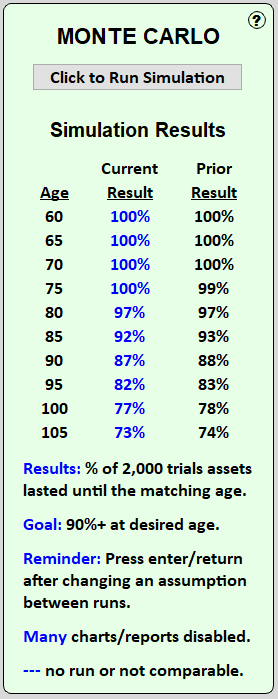

Nevertheless, users have the option to also run Monte Carlo simulations with the click of a button on the Relax planner. Our Monte Carlo simulation shows the percentage of time your assets lasted until the corresponding age, which ranges from your current age to age 105. This compares to the typical Monte Carlo simulation that only shows the probability of your savings lasting until one age the user selects.

Having both options allows users to compare and contrast each method as a “second check” on the longevity of their retirement savings.

Good retirement calculators are valuable planning tools

Before building our calculator, we examined a myriad of other retirement planning tools. Some of them were good, many were bad. We have outlined what features to look for and things to avoid when seeking a “good” retirement planner. We agree with many of the criticisms of retirement calculators, which is why we designed our retirement planning tool to address them.